Recently, some members of parliament have complained in the national parliament that the two banks have waived the interest of these institutions in violation of the rules and regulations.

They termed it as against the discipline of the banking sector.

Former bankers and analysts, however, say that if the banks waive the interest of some institutions with the approval of the central bank, the pressure will ultimately fall on the general customers or depositors of the bank.

However, the two banks which have waived off interest of about 6500 crore rupees have not agreed to make any further comments on this.

Among them, an official of one of the banks said that the loan waiver decision of one institution has been canceled and one institution has paid all the dues of the bank.

What is known about interest waiver

It is learned that the state-owned Janata Bank has waived interest of Tk 4,224 crore to three business groups.

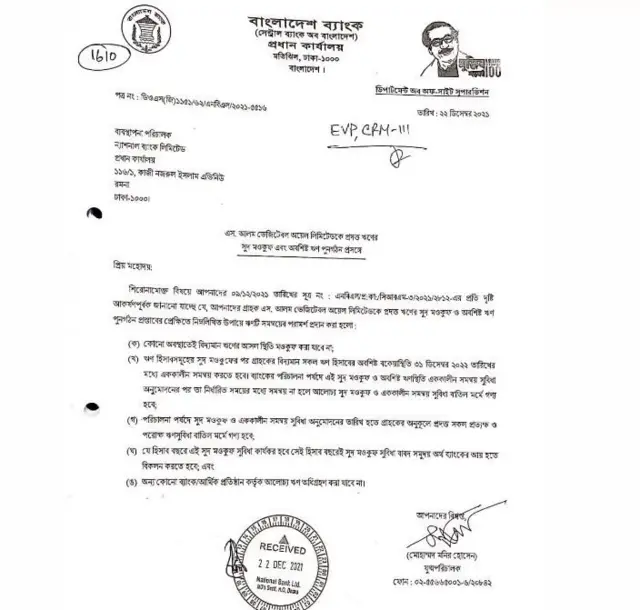

And the private National Bank has waived interest of Tk 2,283 crore only for S Alam Group and this has been done for the next ten years from 2010.

Both these banks were once known as good banks, but now that is no longer the case. Rather, the private sector bank has recently come under discussion due to various irregularities and the central bank has also had to intervene in the management of the bank.

The total amount of defaulted loans of the two banks is now more than thirty thousand crore rupees.

Recently, some parliamentarians in the national parliament said that none of the reasons for waiving loan interest are applicable to these institutions.

On June 10th, Jatiya Party Member of Parliament Mujibul Haque Chunnu said that there are four instruments for an individual or organization to waive interest, and the interest of organizations that do not have any of them has been waived.

Then on Tuesday, Jatiya Party member Hafiz Uddin Ahmed, independent member Pankaj Debnath and Hamidul Haque Khandkar brought the issue up again.

Mr. Ahmed criticized the interest waiver and said that Bangladesh Bank is not able to exercise its power. 10/12 banks are on the verge of closure and their financial condition is fragile.

Pankaj Debnath said, interest is waived due to natural calamities, death of borrowers, calamities. But nothing happened to him here. There was no disaster. Rather, interest waiver has been given with flimsy excuses.

IMAGE SOURCE,GETTY IMAGES

How is interest waived off?

According to the rules of Bangladesh Bank, loan interest can be waived due to some reasons like death of the borrower or natural calamity. In 2022, the central bank issued a circular in this regard.

It said that banks can waive interest on loans due to various uncontrollable reasons such as death of the borrower, natural calamities, epidemics, river floods, distress reasons or closure of projects.

In the circular, the Central Bank cautioned and said, “However, recently, it has been seen that banks are often waiving off the interest of various customers without considering these special circumstances. This may create disinclination among the customers to pay the dues of the bank within the stipulated time to get the interest waiver facility, which the bank Overall credit to the sector is against discipline.”

However, it appears that the reasons or conditions contained in the circular do not match those of the business groups for which interest has been waived.

Again, two officials of both the banks have confirmed that both the banks have taken the no-objection letter from the central bank in the case of loan waiver. They requested anonymity.

Former banker Nurul Amin told BBC Bangla that the banks that have waived interest have done so within the rules of Bangladesh Bank and the Bank Company Act.

“A bank can waive the amount of interest which is less than the total cost of funds of that bank. This is the current policy. So everything is going within the rules. Only the central bank can make exceptions to this as per law. They can change and modify the policy in public interest,” he said.

He said that everything is done according to the regulations of Bangladesh Bank and they fix the loan policy, loan reschedule policy and interest waiver policy.

How does it affect customers?

And the professor of banking and insurance department of Dhaka University. Hasina Sheikh said, many times banks take such decisions to bring back large loans.

“However, it is not known how much profit it brings. Rather, there is nothing to give a new chance to those who default,” he added.

Nurul Amin says that it destroys the trust of customers. They feel deprived. Waiver of interest in this way is immoral and against good governance.

“A lot of times this reduces the overall profit or profit of the bank. The shareholders are deprived of it. Even those who take a small loan from the bank for various needs, the interest rate may increase due to the large scale interest waiver,” said Mr. Amen.

Generally, banks think that it is better to collect the money loaned even with some discount. Later the money will be invested in other sectors and profit will come. That is why sometimes they take decisions like interest waiver.

“It is often more important for the bank to get something with a small discount than to get nothing without giving any discount to the player,” said Mr. Amen.

Dr. Hasina Sheikh says these frustrate depositors and create a kind of mistrust of banks among customers.

“Banks should take these into account while giving special benefits to senior citizens,” he said.